Development Method of Real Options Theory Implementation for Oil & Gas Fields Plan of Development

Conventional Net Present Value (NPV) is one of the very simple and popular methods that is used for a valuation of projects and for decision making regarding investments in planning of a field development. Conventional NPV analysis involves the estimation of an investment’s worth by applying a risk-adjusted discount rate to expected net cash flows derived by applying an expected price case to expected output at that price.

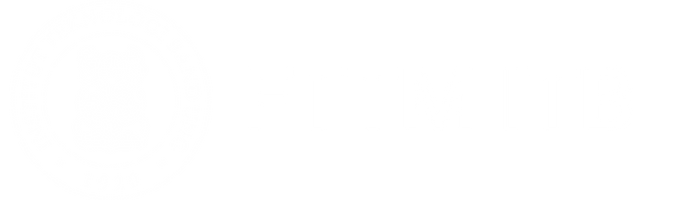

However, there are some important aspects which are not taken into account by the conventional NPV in many types of projects valuation. One of them is managerial flexibilities. Options that are derived from them are commonly called “real options” which is associated with project uncertainties. Binomial Method with risk-neutral probabilities is used to approximate them, associated with the changes in the value of a project over time. There are three methods that will be used to solve the binomial problem. The Cox, Ross, and Rubenstein (CRR), Jarrow-Rudd, and Tian method.

Figure 1. Binomial methods: (a) Binomial Tree (b) Binomial Lattice (After Brandao et.al., 2005)

This study shows how real options theory can be applied for valuation of an oil and gas field development in Indonesia by following the Indonesian PSC (Production Sharing Contract). In this field, there are options which can be taken into account such as investing to enhance production, drilling certain number of wells, waiting, or shutting down the field (abandon).

Figure 2. Dynamic Project Present Value of On-Going POFD Project of Oil Field-X after the real option is employed

The Real Option Theory is applicable to the oil and gas industry. The conventional NPV method is tend to under-assess the value of the project, since it could not accommodate the flexibilities of managing investment which is hold by the managerial at any time during the project life. Real Option Theory can prevent the under-assessed project value because it can mitigate the technical or market uncertainties by utilizing the managerial flexibilities.